Accounts Payable Automation

Is manual data entry slowing you down?

Supercharge your financial operations with accounts payable automation software—the key

to streamlined, efficient, and secure AP processes.

What Is Accounts Payable Automation?

Accounts payable automation refers to technology that makes the accounts payable processes in your business easier and more efficient. It works by removing the need for tedious manual tasks, such as entering data by hand, and simplifies complex financial procedures. This allows the accounts payable team to spend less time on routine tasks and more on value-adding activities.

“Our administrative staff is no longer chasing invoices. Now, they are supporting leadership in more meaningful ways which translates to both higher value to the company and a clearer growth path for employees. Instead of admins, we now have department coordinators who can be promoted to assistant manager, even manager.”

—Mike Sorensen, General Manager, Coast Counties Truck & Equipment Co.

Here are some of the core components of AP automation:

Advanced automation tools seamlessly capture supplier invoices from diverse sources, digitize the information, and accurately categorize the data. This approach removes the need for manual tasks and associated human error.

AP software automatically routes invoices to the relevant parties for approval. Based on established rules, this automation accelerates the process and eliminates the risks of delays or misplaced invoices.

Automated systems guarantee timely, accurate payments. They can synchronize seamlessly with your existing financial systems, so you don’t have to rip and replace the tools you currently use.

An automated system diligently records and traces all transactions, simplifying compliance with financial regulations. This functionality also streamlines auditing, de-risking an otherwise stressful and time-consuming process.

What Are The Benefits of AP Automation?

Accounts payable automation significantly enhances your business’s management of invoice data. The transformation it provides streamlines operations and fosters improved supplier relationships, all while reducing costs. Here are some of the key benefits.

An AP automation solution reduces the need for manual data input, freeing up employees’ time for more valuable tasks. Enhanced speed shortens invoice cycle times, opening opportunities for early payment discounts.

Automated accounting systems can mitigate errors in data input and calculations. They standardize invoice processing, applying consistent rules for approval and payment. This ensures all transactions are correctly managed, and irregularities can be immediately flagged for remedial actions.

Automating the AP process leads to significant cost savings in manual labor, errors, and paper supplies. The scalability of automation accommodates growing invoice volume and transaction complexity without a proportional increase in spending.

AP automation offers real-time visibility into accounts payable processes, supporting effective cash management. Enhanced data sharing reduces back-and-forth communication with suppliers, promoting a streamlined process.

AP automation reduces fraud risk by tightening controls and maintaining digital audit trails. These digital workflow trails make it more difficult for fraudulent activity to go unnoticed and any suspicious behavior easier to investigate.

Automation prompts timely, precise payments, fostering better supplier relationships. Supplier portals allow easy invoice and payment tracking, minimizing constant follow-ups, boosting trust, and improving future contract negotiations.

Automation ensures compliance with laws and regulations and maintains a clear record of transactions. A centralized, searchable database makes data highly accessible, saving time and frustration when hunting for information.

AP automation transitions businesses from manual, paper-based systems to streamlined digital processes. Digitizing the AP department eliminates physical storage and reduces the risk of damaged or lost documents.

Reducing reliance on physical paper processes supports environmental sustainability. Digitizing invoices and other financial documents minimizes waste and carbon footprint, contributing to your company’s corporate social responsibility initiatives.

AP automation solutions integrate seamlessly with ERP and other back-office systems, simplifying consolidation and data analysis across different business areas. Centralized data management delivers operational efficiency and strategic insights, improving decision-making in line with strategic financial objectives.

What Is Accounts Payable Automation Software?

Accounts payable automation software, also known as AP automation software or AP software, is a next-generation solution that amalgamates various sophisticated technologies. These include advanced optical character recognition (OCR) for precise data extraction, artificial intelligence and machine learning (ML) for accurate invoice matching and anomaly detection, document management systems for secure storage, and data analytics tools for insightful performance analysis.

AP software also operates as a comprehensive and secure digital repository, meticulously recording and storing every invoice, approval, dispute, and payment, thereby boosting transparency and compliance.

A best-in-class AP solution brings automation to the forefront of every aspect of the AP process–from purchase orders to invoice receipt, matching, approval, payment processing, submission, transaction recording, and reporting. It also manages the intricate routing procedures that underpin these operations.

In essence, AP automation software offers an efficient, transparent, and robust approach to handling your organization’s accounts payable operations, paving the way for heightened financial efficiency. It’s a must-have element in your organization’s journey toward digital transformation.

“We’re able to pay invoices on time and take any discounts that are offered to us. We don’t miss out because we’re waiting for a buyer to approve something. I would definitely recommend Epicor ECM software to others. It makes it easy for our employees to access the documents they’re looking for. It is all very easy to use.”

—Shelly Weidig, Software Developer | Masters Gallery Foods

How Does AP Automation Work?

The use of advanced technology for automating accounts payable dramatically simplifies and speeds up how you handle invoices. It ensures the end-to-end process is taken care of quickly, accurately, and without any hassle.

Here’s the AP automation process flow:

The first step in AP automation is capturing supplier invoices through email, electronic data interchange (EDI), or traditional mail. The system uses technologies like optical character recognition (OCR) to extract invoice information from various formats, including paper, PDF, and electronic files.

After capturing invoices and extracting pertinent information, the system subjects them to an approval process. This process is automated and based on predefined rules. For instance, if an invoice is under a specific dollar amount, it might be automatically approved. If it’s over that amount, it might require approval from a manager or accounts payable department head.

The system automatically matches each invoice with its corresponding purchase order and delivery receipt. This three-way matching process verifies invoice accuracy and removes the risk of duplicate invoices and payments.

Once approved, the invoice goes into the payment queue to be processed automatically. The software can make payments directly or integrate with your existing payment processing tools. The system ensures that payments are made on time, taking advantage of early payment discounts and avoiding late payments and fees.

All actions taken within the AP automation system are tracked, creating a clear audit trail, including approvals and reviews of invoices. This data can be used in reports, giving businesses valuable insights into their spending habits, vendor performance, and potential bottlenecks in their AP process.

Accounts payable automation software integrates with your company’s existing ERP or accounting system. This allows for real-time updating and sharing of financial data across your company, ensuring everyone can access the most current and accurate information.

Overcoming Challenges Facing AP Departments

The financial landscape is evolving rapidly, demanding swift and strategic adaptations by accounts payable departments. Implementing AP automation is a robust response to these ongoing changes. Let’s explore how this innovative technology can effectively address today’s most critical challenges.

AP automation software incorporates advanced encryption techniques and multi-factor authentication systems, ensuring all financial transactions and data exchanges are secure. This protects against threats like hacking and data theft and makes every transaction traceable.

AP automation tools keep track of the regulatory landscape and automatically update compliance rules and processes. This dynamic adaptation mitigates the risk of non-compliance penalties.

AP automation software consolidates complex global supplier data, simplifying management tasks. By centralizing this information, for example, you gain a comprehensive overview that can identify potential risks, like delivery delays or regulatory issues, across different geographical markets.

With AP automation, you can eliminate paper invoices and ensure that every step of your AP process contributes to sustainability efforts. Reducing waste and emissions is increasingly vital as eco-conscious companies can attract and retain top talent.

AP automation tools effectively transform diverse unstructured data into organized, structured information. This information can be efficiently stored and analyzed to drive business growth.

AP automation automates the creation of detailed reports using real-time data. This increases transparency and trust, saves time, reduces payment errors, and helps meet increasingly stringent reporting demands from stakeholders.

How to Select Accounts Payable Automation Software

AP software has transformed how businesses manage their finances. With the capacity to automate repetitive tasks, eliminate erroneous payments, and reduce invoice processing time, it has become a vital instrument in any financial management toolkit.

But with so many choices out there, knowing what makes the best AP software shine is essential. Here are the key features to consider when selecting the right solution for your business.

A core feature of AP automation software is intelligent data capture, including Optical Character Recognition (OCR). This technology enables the software to interpret and extract unstructured data from diverse document formats such as invoices, receipts, and purchase orders.

Intelligent data capture eliminates the time-consuming task of manual data entry and minimizes the risk of human error. It improves the accuracy and speed of data processing, making financial management more efficient.

The ideal software should cater to various business models by providing both cloud-based and on-premise AP automation solutions.

Cloud-based solutions are perfect for businesses prioritizing scalability, easy access, and reduced IT costs. On the other hand, on-premise solutions offer greater control and customization, an essential feature for companies with unique needs or those operating in heavily regulated industries.

Seamless integration with existing systems like ERP is vital. This interoperability ensures a smooth data transition between systems, eliminating the need for manual data transfer. It promotes data consistency across different business processes and seamless collaboration between the AP department and other functions.

Artificial Intelligence (AI) and Machine Learning (ML) technologies can take AP software to new heights. These technologies can automatically classify documents and assign them to the appropriate process.

For instance, the system might learn to recognize specific vendor invoices based on previous entries and automatically categorize them accordingly. This function improves over time as the system learns from past actions, increasing accuracy.

In our mobile-centric era, an exceptional mobile user experience is a must-have feature for any AP system or automation solution. The software should allow users to approve invoice data, view reports, and perform other tasks from their mobile devices. This on-the-go accessibility enhances convenience and speeds up the AP process by enabling immediate action, regardless of the user’s location.

Robust data security measures and a comprehensive disaster recovery plan are essential for any AP automation software. It should have reliable backup systems to protect your financial data from potential losses due to unforeseen events or cyber threats. Compliance with data security standards is equally important to ensure the confidentiality and security of your financial data.

Best-in-class software provides robust real-time insights into your AP processes, such as average invoice processing times, the number of early payment discounts captured, and the efficiency of your staff in processing invoices. These insights are vital for tracking performance, identifying bottlenecks, and facilitating strategic decision-making.

Configurable workflows are another essential aspect of top-notch AP automation solutions. The software should be capable of routing invoices for approvals automatically, based on predefined rules, and adept at handling exceptions. Businesses should be able to adjust approval workflows to different variables unique to their business.

AP Automation FAQs

The accounts payable automation process is a system where technology performs the manual aspects of processing invoice data. This includes invoice capture, validation, match and approval, and payment.

To automate accounts payable, select the software that best suits your business needs and import your vendor invoices into the system. The software will handle the rest of your AP processes, including validation, matching, approvals, and payments.

Disadvantages of accounts payable automation may include:

Automation in accounts payable means using technology to perform tasks traditionally performed by humans. Automation drives efficiency and reduces errors.

To automate the accounts payable process, first, identify your business requirements. Then select a suitable AP software, implement the software, train your AP team, and continuously monitor and improve the process.

We automate accounts payable and other accounting systems to increase efficiency, eliminate erroneous payments, enhance control over cash flow, improve supplier relationships, and allow staff to focus on strategic tasks rather than manual data entry.

AP automation streamlines invoice approvals by reducing manual tasks, automating matching and verification, and allowing easy tracking and audit trails. This results in quicker approvals and fewer mistakes.

AP automation can resolve issues with invoice-related communication by providing real-time updates and easy tracking of invoices, minimizing disputes, and facilitating prompt communication within a supplier portal.

The software aids AP teams’ scalability by streamlining invoice processing, automating manual tasks, and offering a capacity beyond manual processes.

AP automation prevents duplicate payments by using intelligent algorithms to cross-check and detect duplicate invoices before payments are made, thereby reducing financial errors.

AP automation improves document management by digitizing invoices, facilitating easy search and retrieval, reducing the need for physical storage, and improving compliance with audit trails.

AP software can integrate with ERP systems via APIs. Integration provides seamless data flow, reduce manual data recording, and ensure accuracy and consistency in financial information across the organization.

Accounts payable software can prevent invoice fraud by automatically cross-referencing and validating invoices against purchase orders and delivery receipts and identifying discrepancies or unusual patterns.

Yes, AP automation can automate the match and verification process, cross-checking invoices against purchase orders and delivery receipts and automatically flagging any discrepancies for review.

AP software can improve supplier relationships by ensuring timely payments, reducing invoice errors, and providing suppliers visibility into invoice and payment status.

AP automation improves the invoice approval process by eliminating manual work, automating the matching and verification of invoices, and allowing for real-time tracking and approval of invoices. This results in a quicker, more efficient, and error-free approval process.

Yes, AP automation solutions are designed to work with any accounting system. Through seamless integration, these solutions can exchange data with your existing accounting system, ensuring consistency and accuracy of critical financial data.

AP automation aids the approval process by automatically matching invoices to purchase orders and delivery receipts. The system can then route invoices to the appropriate person for approval, speeding up the process and reducing manual errors.

AP software handles tax compliance by automatically calculating and validating the taxes on invoices. It can be set up to comply with various tax regulations across different jurisdictions, helping businesses avoid penalties and maintain compliance.

The amount a business can save with AP automation can vary, but some studies suggest that automation can reduce invoice processing costs by up to 80%. Savings come from reduced labor costs, fewer errors, and better.

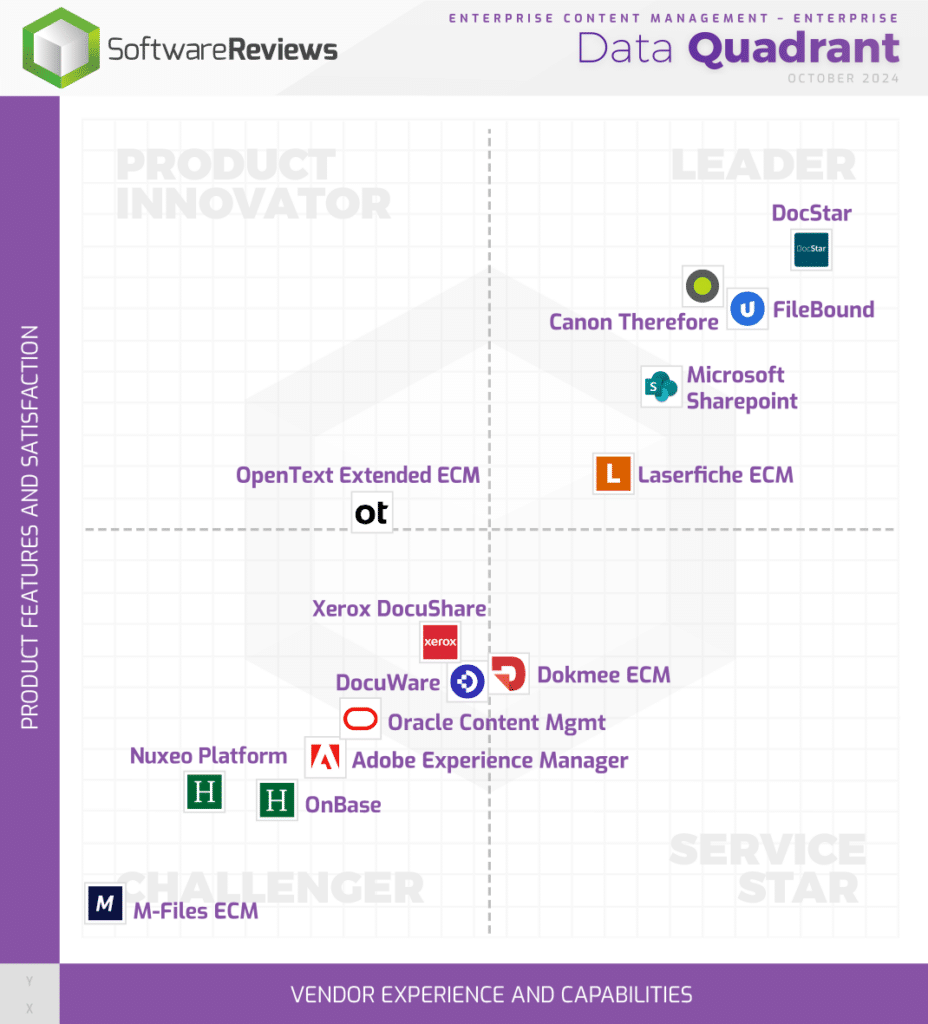

Nucleus Research Releases 2023

Content Services & Collaboration Technology Value Matrix

DocStar Named Leader in Value Matrix